SpreadsheetConverter lets you create web pages with live formulas. Formatting sections in dragon professional for mac. One example is when sales tax is added to a sale. You create your formula-driven web page directly in Excel, with the skills you already have. The resulting web page may be simple, but very promising.

Contact mac designs software. In this example, a calculating web page is created in a few minutes. We start with a very simple Excel spreadsheet, and create a web page that looks the same and calculates the same. We’ll then publish the web page on the web and add the calculator to an existing web page in WordPress.

Facebook; Instagram; Visit Sumner County; Car purchase price: Trade in amount. A use tax is generally assessed on purchases made by a resident in a state that does charge a sales tax when the purchase is made from a state that does not charge a sales tax. You will generally calculate either a state or use sales tax but not both however, 2 separate fields are provided for clarity. Texas has a 6.25% statewide sales tax rate, but also has 827 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 1.372% on top of the state tax. Check out the Reverse Sales Tax Calculator as well to calculate how much your item was without sales tax included. How to Calculate Sales Tax. Let's be honest - sometimes the best sales tax calculator is the one that is easy to use and doesn't require us to even know what the sales tax formula is in the first place! But if you want to know the. The state of Washington taxes all sales of automobiles at a rate of 6.5 percent, which is the standard retail sales tax. In addition, Washington county taxes are applied as well at a rate of 0.3 percent of the sales price.The tax money collected is allocated toward various state funded services like road maintenance.

For European visitors, we have also provided a version of this tutorial for value-added tax (VAT).

The spreadsheet

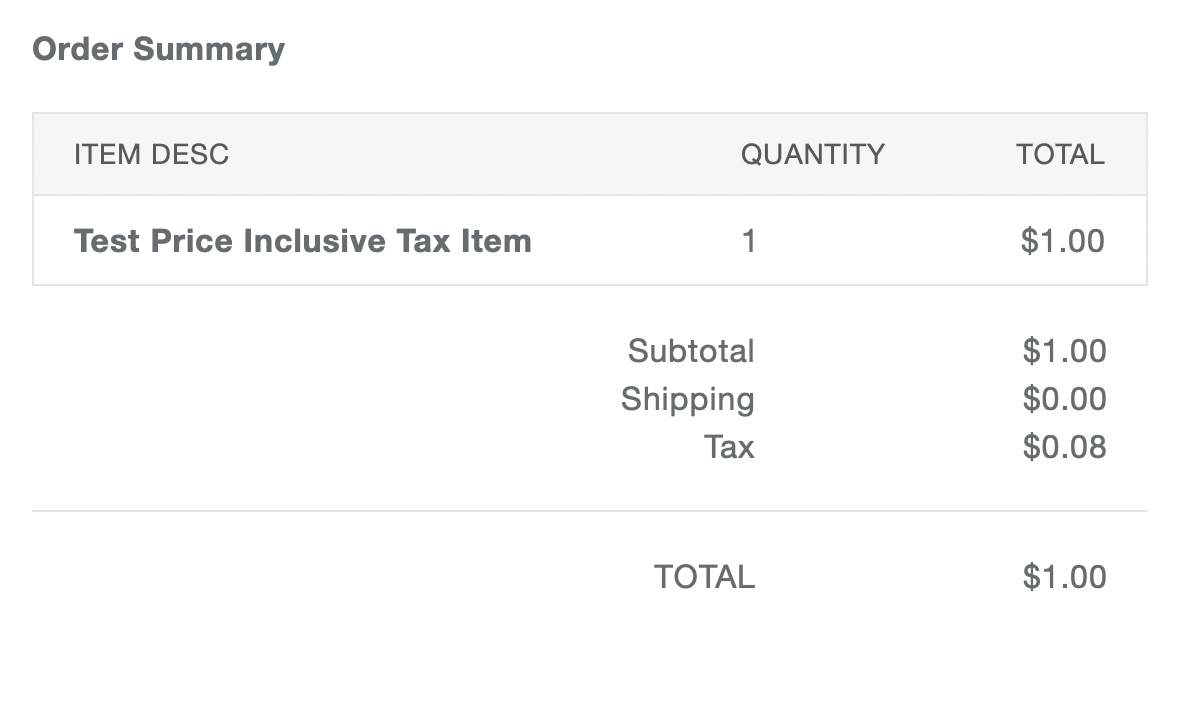

It is a simple spreadsheet that takes a user entered price and tax rate, and displays the sales tax amount and the total price with sales tax.

The formulas are:

sales tax in dollars = price_without_tax * sales tax rate in %

total price = price_without_tax + sales tax in dollars

If you don’t want to practice using the product,

the original spreadsheet can be downloaded here.

Layout and formatting

How to stand out in an era of fake news stories. The settings for layout and formatting in Excel are carried over to the converted web page. To create this example, do the following:

Automatic Sales Tax Calculator Estimate

- Merge and center the cells A1:D1

- Set the font size of A1 to 14

- Set the background color (Format Cells > Fill) for the heading and the calculated values

- Format the fields with currency symbols, decimals and thousands separators.